For decades, finance experts have described good debt as a debt to buy an appreciating asset such as a house or shares and bad debt is debt that doesn’t such as credit cards and personal loans for holidays but what if we looked at this argument in a different way.

Here are 2 different situations but with the exact same purpose, which is good debt and which is bad debt.

Carol needs $10,000 to buy a car to get to her new job but without the car she cannot get to her new job. The job is FT and the pay is very good.

Jimmy needs $10,000 to buy a car to get to his new job but without the car he cannot get to his new job. The job is part time for a few hours per week and pay is minimal.

Based on the current definitions of good and bad debt, both Carol and Jimmy have bad debt, but do they really?

If we were to look at good and bad debt on the basis of our ability to repay the debt instead of what the debt is actually for, we begin to have a more realistic and relevant perception of whether the debt we have is good or bad but the one thing that still stands true is bad debt should always be paid off before good debt.

The point is, we should not feel bad about what we go into debt for, we should only feel bad when we go into debt knowing it is going to be difficult to pay back.

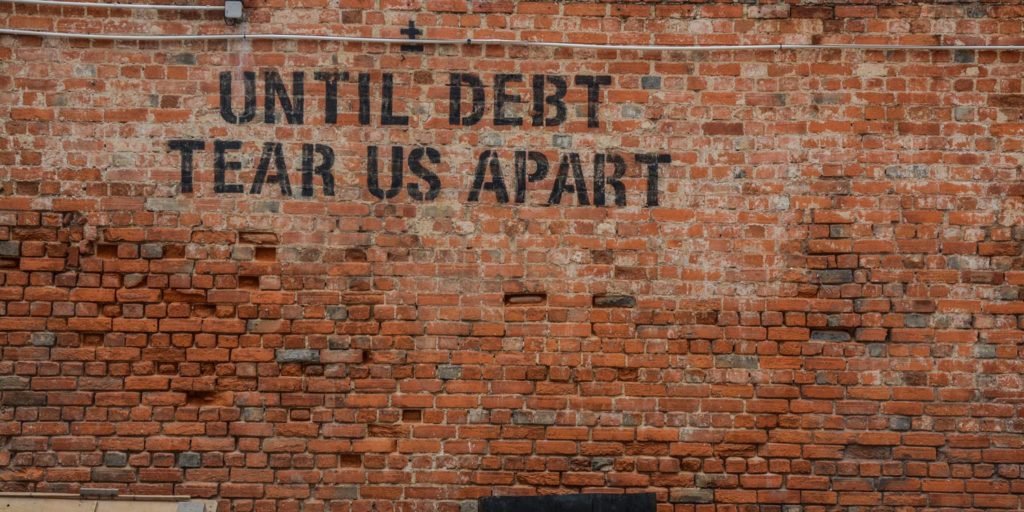

Image by Alice Pasqual